1.1 Purpose The purpose of this Policy is to create an environment at Allied Bank Limited (the Bank) whereby the employees/vendors/service providers/concerned are encouraged to reveal and report, without any

fear of retaliation, subsequent discrimination and of being disadvantaged in any way, about any fraudulent, immoral, unethical or malicious activity or conduct, which in their opinion may cause financial or reputational loss to the Bank.

2. Corporate Whistle Blowing Policy of the Bank provides assurance to the Whistle Blowers about secrecy and protection of their legitimate personal interests. It also provides incentives for the Whistle Blowers upon report of suspicious activities.

3. It is the Bank’s policy to support and encourage current or former employees of the Bank, shareholders, vendors, contractors, service providers, customers or the general public to report and disclose fraudulent, immoral, unethical or malicious activities and conduct investigation on such reports. The Corporate Whistle Blowing Policy assures that all reports under this Policy would remain strictly confidential and that the Bank is also committed to address reports (if any) that alleges acts of interference, revenge, retaliation and threats against the Whistle Blowers.

4. The Bank’s internal control and operating procedures are intended to detect and to prevent or discourage such activities; however, even the best systems of controls cannot provide absolute safeguards against irregularities. Therefore, all employees are encouraged to report any such activity or act / misconduct that may cause financial or reputational loss to the bank.

1.2.1 Whistle Blowing

Whistle Blowing is a communication to a competent authority by an individual or an institution to expose and / or inform upon, alleged fraudulent, immoral, unethical or malicious activities or discrimination or

some other type of adverse occurrence that violates a law, regulation, policy, morals, and/or ethics and especially those matters that jeopardize the credibility and reputation of the Bank as a trusted financial services provider.

1.2.2 Corporate Whistle Blowing Policy

Corporate Whistle Blowing Policy is to encourage the Whistle Blowers to voice their concerns to an appropriate pre-identified authority about any fraudulent, immoral, unethical or malicious activities, which are against the policy of the Bank or may have an adverse impact on the business or goodwill of

the Bank or the society at large without any reservations of retribution such as fear for the loss of job, discrimination, victimization, harassment etc.

1.2.3 Whistle Blower

Whistle Blower is a person or institution, who blows the whistle and sends communication to the entrusted authority, following the process as prescribed, includes current or former employees of the Bank, shareholders, vendors, contractors, service providers, customers or the general public.

The role of a Whistle Blower would remain to the extent of reporting only, who will neither be considered an investigator nor determines the appropriate corrective or remedial action that may be required under the given situation.

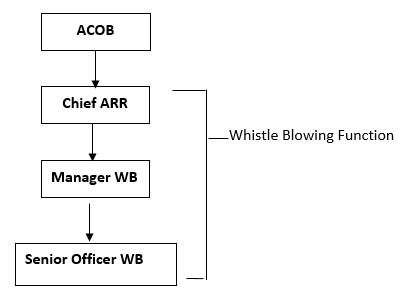

1.2.4 Whistle Blowing Function

An operationally independent function established, under supervision of ACOB, for handling and monitoring allegations, complaints and concerns raised by the Whistle Blower under Whistle Blowing policy

1.2.5 Investigator

Chairman ACOB shall advise the whistle blowing complaints to Chief ARR or any other appropriate Bank Executive or outsource to any investigator. Chief ARR shall get the investigation conducted as per

investigation procedure of the Bank. If the complaint is against Chief ARR, the person so designated by Chairman ACOB for investigation may delegate the investigation to any person out of ARR or outsource to any external agency.

1.2.6 Allegations

This refers to making an accusation before proving with evidence or raising a concern or assertion that prima facie someone in the employment of the Bank did something illegal or committed a wrong doing, individually or in connivance with other against the interest of the bank.

1.2.7 Good Faith

Good faith is evident when the report is made, in the interest of the Bank, without consideration of

personal benefit and not based on personal grudges and enmity, and the Whistle Blower has a reasonable basis to believe that the contents of the report are true. However, it is not necessary that a report made in good faith, proves to be true.

1.2.8 Misconduct

Examples of Misconduct include, but are not limited to, financial fraud, violation of laws and regulations, violation of Bank’s policies, immoral or unethical behavior or malicious practices, negligence of duty and threats to the Bank.

1.2.9 Retaliation

Retaliation means any act of discrimination, revenge or harassment directly or indirectly taken against a Whistle Blower, by any person, for making a disclosure under this Policy.

1.2.10 Protection

Protection means all reasonable steps taken by the Bank to ensure confidentiality of the Whistle Blower’s name as well as measures enforced to protect the Whistle Blower from retaliation and financial losses.

The Audit Committee of the Board (ACOB) shall be responsible for implementation of this Policy.

This policy shall be applicable to all of the bank’s employees and outside parties such as shareholders, vendors, customers etc. The Whistle Blowing Policy is applicable to the entire Bank including its overseas operations.

This policy shall be available on ABL Share Point portal as well as on ABL’s Corporate Website.

The success of this Policy depends in part on the integrity, observation and professional ethics of the Whistle Blower & respondent(s) as well as on the level of confidentiality maintained. However, retaliation by workplace peers and harassment or victimization by the management, are the major disincentives to Whistle Blowing. Therefore, to avoid the possibility of emotional, psychological and/or physical harm upon the Whistle Blowers as a result of Whistle Blowing, the Bank stands committed to safeguard the Whistle Blowers.

All matters will be dealt with confidentiality and the identification of the Whistle Blower will not be disclosed except for inevitable situations, where disclosure of identity of the Whistle Blower is essential (for instance, his / her statement/evidence is needed in court) or report of a complaint has to be disclosed

to those persons who have a need to know in order to properly carry out an investigation of the complaint.

The Chief ARR shall be responsible for keeping this document updated from time to time. Therefore, this Policy shall be subject to a formal review by the Chief ARR on a periodic (at least once in every three years) basis and the proposals for any changes / modifications/ amendments therein shall be submitted to the

ACOB for consideration and its further recommendation to the BOD for approval.

Whistle Blowing Function has been formed under supervision of ACOB.

2.1 Objectives

The intended objectives of this policy are:

i. To strengthen culture of transparency and trust in the Bank by encouraging all the employees, vendors, service providers and concerned to blow whistle where they may genuinely know or suspect any immoral, unethical, fraudulent act of any current or former employees, vendors, Chief ARR ACOB

Manager WB Senior Officer WB contractors, service providers and customers which may have potential to cause financial or reputational risk or loss to the Bank.

ii. To create awareness amongst employees and stakeholders regarding the Whistle Blowing Function;

iii. To enable Management to be informed at an early stage about fraudulent, immoral, unethical or malicious activities or misconduct and take appropriate actions.

iv. Provide a swift and confidential process for rectifying malfeasance wherever and whenever it occurs in the Bank.

The scope of this Policy includes, without limitation, the following:

i. Unlawful acts or orders requiring violation of a law or regulations of State Bank of Pakistan / central bank(s) of other jurisdictions where the Bank operates, other criminal activities, mismanagement, abuse of authority and misuse of Bank’s resources including any attempts to conceal any of the

forgoing acts;

ii. Fraud – an intentional act by one or more individuals amongst management, those charged with governance, employees or third parties, involving the use of deception to obtain an unjust or illegal advantage;

iii. Falsification of books of accounts or related documents and records including any serious violations

in financial reporting;

iv. Endangerment of the health or safety of any person;

v. Corruption/ Bribery – the offering, giving, receiving or soliciting, directly or indirectly, anything of material value or providing undue benefits to influence improperly the actions of another person / employee;

vi. Misconduct – failure by the Bank’s personnel to observe the Bank’s policies, rules and Code of Personal & Professional Standards including those resulting in embezzlement of funds and conducting of parallel banking activities;

vii. Collusive practices – an arrangement between two or more persons / employees designed to achieve mala fide objectives, including improperly influencing the actions of another person / employee; and

viii. Any other activity which undermines the Bank’s operations, reputation and mission.

2. The scope of Corporate Whistle Blowing Policy, is distinctive from ‘Anti-Harassment Policy’ and ‘Employees Grievances Handling Procedure’. Accordingly, matters falling in the purview of ‘Anti- Harassment Policy’ or ‘Employee Grievance Handling Procedure’ shall not be reported under Corporate

Whistle Blowing Policy.

3. This Policy is not designed to question financial or business decisions taken by the Bank nor should it be used to reconsider any other matters which have already been addressed under other procedures, rules or regulations of the Bank.

1.The information given and the identity of the Whistle Blower will be treated in a confidential manner

as per sub-section 1.7 of the policy.

2. The Bank stands committed to protect Whistle Blowers for Whistle Blowing, harassment or

victimization of the Whistle Blower will not be tolerated.

3. If the Whistle Blower feels that, at his / her place of posting, he / she might be subjected to victimization or harassment by the alleged officials after blowing the whistle, the management may consider transferring him/her to another suitable place on his/her request. However, this assurance is not extended in cases where it is proved that the Whistle Blower raised the matters to settle his / her personal grudges or grievances or enmity or where the Whistle Blower has been habitually involved in complaining petty issues.

4. Protection that Bank can extend to Whistle Blower is limited to the Bank’s capability, but any retaliatory action against any Whistle Blower as a result of whistle blown by such person under this Policy shall be treated as Misconduct and subject to disciplinary action.

5. Indemnity from disciplinary action will be provided to the Whistle Blower employee, against actions/involvement in the activity against which whistle is blown, based on the merits of the subject case.

4.1 Bank’s Responsibilities

1.The Chief ARR will circulate Corporate Whistle Blowing Policy twice a year for the information to all the employees of the Bank.

2. The communication channels for whistle blowing complaints are as follows:

• A dedicated e-mail address for Whistle Blowing ([email protected]) which will be accessible by the Chairman ACOB.

• Whistle blowing forms available on the Bank’s Corporate Website.

• Post / courier addressed to Chairman ACOB, Allied Bank Limited, Head Office, 3 Tipu Block,

New Garden Town, Lahore.

3. Where Whistle Blower sends communication on postal address given in this Policy, it will be ensured that the complaints are delivered directly to the Chairman ACOB without any change. However, whistle blower may mark ‘Confidential’ on the outer side of envelope.

4. A mechanism will be put in place to evaluate effectiveness of Whistle Blowing Function under this Policy. Under that mechanism, MIS relating to issues raised through Whistle Blowing arrangements

and management response to such issues will be reported to ACOB periodically. In addition to this, names of the official(s) responsible for receiving, handling and monitoring whistle blow complaints shall be presented to ACOB for periodic review.

5. Whistle blowing concerns requiring reporting as per law or applicable regulations, may also be directly escalated to the State Bank of Pakistan/ Supervisory Point of Contact at central bank of other jurisdictions where the Bank operates.

6. The Bank will ensure that the Corporate Whistle Blowing Policy is fairly and consistently applied. It should spell out zero tolerance for all violations e.g., fraudulent, immoral, unethical or malicious activities.

7. It will be ensured that Whistle Blower feels secure while reporting fraudulent, immoral, unethical or malicious activities.

1.In the event that any fraud, forgery, fraudulent, immoral, unethical or malicious activities have occurred due to involvement of the Bank’s officials, the employees who have knowledge are ethically and morally bound to Whistle Blowing or take appropriate action if they are authorized to.

2. It is expected that the Whistle Blower shall remain unbiased while reporting matters under this Policy.

3. In making a disclosure, the Whistle Blower should exercise due care to ensure the accuracy of the information. Whistle Blower should not make repeated, malicious, wrong, not based on facts, based on personal grudges, grievances or personal enmity or vexatious allegations. In such a case, appropriate action may be taken against the Whistle Blower.

4. The Whistle Blowers are encouraged to share their identity enabling Bank to provide protection as per Section 3 of this Policy and share the results of investigation, if required.

1.To motivate the Bank’s staff to behave honestly, in loyalty with the Bank, independently without any fear, for saving the Bank from risks of financial or reputational losses caused by fraudulent, immoral, unethical or malicious activities or misconduct of some dishonest and corrupt persons, the management may offer incentives. In order to be eligible for all such incentives the Whistle Blower(s) must share their contact information. In case of anonymous Whistle Blowing, no such reward shall be given to anyone in any situation or circumstances, even if allegations imposed are proved to be correct.

2. On the recommendation of the ACOB to the management, the Whistle Blower, who brings to the notice of the management or report any fraudulent, immoral, unethical or malicious activities, which may lead to financial or reputational losses or legal threats to the Bank, will be suitably awarded

according to the significance of the information he / she had provided and impact of losses averted as a result. The award may include cash prizes and or increase in salary and or promotion.

3. The prizes / awards will be given to the concerned Whistle Blower confidentially and in a manner that no one can grasp the actual reason thereof.

It is expected from all employees to refrain from rumor mongering, irresponsible behavior and false allegations and if staff makes an allegation in good faith, but it is not confirmed by the investigation, no action will be taken against them. If, however, staff makes malicious or frivolous allegations /complaint(s) or misuse Whistle Blowing policy for undue posting/transfer of himself/herself on disclosure to team member/ senior about whistle blown or the shelter available under Whistle Blowing policy, action may be

taken against them after proper investigation.

7.1 Process of Whistle Blowing

The Chief ARR shall be responsible for the development of Whistle Blowing Procedures Manual which shall be approved by ACOB.

7.2 Reporting

Strict confidentiality will be observed in submission of the investigation reports. The report along with the

result of investigation carried out by the team formed shall be submitted to the Chairman ACOB. After approval of Chairman ACOB, report should be referred to the relevant forum, if any action is required.

7.3 Retention of Whistle Blowing complaints

All whistle blowing complaints received at the aforementioned dedicated email address, through mail or through whistle blowing form available at ABL’s corporate website shall be retained for 3 years after which the complaints shall be archived and preserved as per the Bank’s record retention policy.

7.4 Disciplinary Action

1. If involvement of the Bank’s officials in fraudulent, immoral, unethical or malicious activities and other malpractices is proved during investigation of the case then disciplinary action will be initiated as per

applicable rules and procedures of the Bank.

2. For external parties, the Bank may on the basis of investigation report and recommendations, consider taking appropriate legal action against the concerned party.

3. If the matter is of grave nature, the Bank may decide to take legal action against the culprit(s).

7.5 Rights and Obligations of Implicated Employee(s)

1. The employee of the Bank, who is implicated as a result of investigation of whistle blowing complaint, shall have the right to be informed in writing, to respond to the charges levelled against him, to put his

defense in Domestic Enquiry (where applicable) as per Disciplinary Action Procedure mentioned in Employee Service Rules of the Bank.

2. If any penalty/punishment is imposed on any employee of the Bank, he / she shall have the right of appeal to the competent authority against such decision as per Employee Service Rules of the Bank.

3. The implicated employee is obliged to furnish factual and accurate information as known by him/her and to maintain confidentiality of the matter.

4. It is the responsibility of every employee of the Bank to extend full cooperation during the investigation of the whistle blowing complaints.